On October 12, our Founder and President Dr. Roger Moczygemba had the opportunity to join Brett Shoemaker, podcaster, business advisor in healthcare, and advocate of the DPC model, in an episode of the Direct Primary Care Benefits podcast.

You can listen to the interview here, or read the transcript below.

Episode 5 – Direct Primary Care Benefits Podcast

Episode 5 Direct Primary Care Benefits Podcast: Dr. Roger Moczygemba of Direct Med Clinic

Introduction

Brett Shoemaker: Welcome to Direct Primary Care Benefits Podcast. Your resource to understanding how DPC and the direct care model are fixing healthcare for employers and individuals alike. Learn from the most innovative and disruptive business executives, brokers, physicians, and healthcare influencers that are in the trenches changing the way employee benefits are being administered across the country.

I’m your host, Brett Shoemaker. Well, welcome everybody to episode 5 of the Direct Primary Care Benefits podcast. This is your host, Brett Shoemaker, and I have got a very awesome and exciting guest today for the show. And I’ve got none other than Dr. Roger Moczygemba from San Antonio, Texas, and Direct Med Clinic. I’m super excited about our conversation today.

So welcome to the show, Dr.

Roger Moczygemba: Well, thanks for having me, Brett. I’m, I’m very happy to be here. I’m excited to be here and talk about what we do. You know, we all love Direct Primary Care if we’re in the business and we all love to talk about it.

Brett Shoemaker: Yeah, absolutely. Absolutely. And so what we’re going to be talking about today for all of our listeners, you know, just to reiterate Dr. Roger, you already know, we talk to healthcare brokers, insurance brokers, other employer groups, and, really just anybody who’s in the healthcare direct care space that understands that our healthcare system is broken and we are out and on a mission to fix healthcare. So what we’re going to be talking about today, as you.

Kind of strategized was healthcare versus health insurance and really the false sense of security that people think that they have with insurance because. They think that card in their pocket relates to healthcare. And you and I both know that it really is just, as the free-to-care movement would say, the healthcare cartel, that’s just kind of redirecting money and charging way too much for the care and not even giving the care necessary to create overall health so that we can deliver healthcare.

So I’m excited to dive in here. And before we do that though, Dr. Roger, I want to talk a little bit about your background because I know when we talked offline, you kind of shared with me a little bit about what your background was and how you were introduced to the Direct Primary Care Model. So why don’t you dive in and tell people a little bit about your background and how you got introduced to Direct Primary Care?

Dr. Roger Moczygemba’s Background

Roger Moczygemba: I’m going to go way back for a minute. When I was first starting my practice, back in the 1990s, the internet revolution was spinning up and, I started a startup business for myself there. I let people come in and see me, a new doc, and I’m trying to build my practice so I’m an innovator is what I’m trying to say.

And if they would see me, book an appointment online, and pay for it front, I’d see them on time. So, that was the start of my entrepreneurship and medicine that didn’t up cause I think it was before its time. And due to some other stuff beyond my control with my partner. It didn’t spin up, but then that introduced me to the opportunity to help start a nationwide telemedicine company called Teladoc, and I was the first doctor doing that.

I was the president of the Physician Association of Teladoc for the first 9 years. Then that led me to be able to help another company, a private company, start their own telemedicine service line. I was their medical director for a few years. Then I came across the DPC model when I was working in urgent care in Northern Utah.

And I thought, “Wow, this is really cool.” The folks that pay for healthcare, can actually enter into a direct relationship with the folks that are getting the healthcare.

Brett Shoemaker: What a genius concept, right?

Roger Moczygemba: This is so refreshing and it was a wonderful environment to practice in, and I loved it.

Along the way at that time, I went ahead and got a master’s degree in healthcare administration. And that opened my eyes even more. Then that led me to start my clinic, a Direct Primary Care Clinic in San Antonio. So that’s a little bit about my background. I’m always, I’ve always been an innovator and entrepreneur.

I just like to do things, to find a better way to do things, and what better way than to do things directly if possible? I mean, isn’t that part of just the American way? Doing things directly. We always see these opportunities direct, by wholesale this, wholesale that. So where did we go wrong in healthcare?

Free2Care Conference

Brett Shoemaker: Well, we started to go wrong in healthcare in 1987. Right? Whenever we passed the federal bill that allowed people to get kickbacks, the only industry to get kickbacks. And yet we wonder why we’re fighting this healthcare cartel. Right? But, you and I got to spend some time together with, Mr. David Balat over at the Free2Care Conference. And, real quick before we dive in here, some questions that I had and really very impressed with your background. A couple of things I just learned and you going through that, that I didn’t learn. So I’m excited to dive into that. But first, what did you think about the Free2Care conference?

I was really impacted in a positive way. How was your, take on that?

Roger Moczygemba: know. I went to a lot of conferences this last summer and what I really noticed from the Free2Care conference was that there was not a lot of people there, but the people there were really big-time influencer.

That was what I took away from it. That’s what it was. I was really impressed. I was privileged to be there and part of the Free2Care conference this year.

The Benefits of Telemedicine

Brett Shoemaker: Amazing. Let’s dive in here. So I had no idea that you were actually involved with the original Teledoc. That’s pretty exciting stuff.

Roger Moczygemba: It was, it was early on. It was before its time in a way. And for many, many years, we, we kind of flew under the radar in taking care of people that way. And then eventually, um, as good things evolved, it got to be more and more noticed. Then when the pandemic. We had it in place and it helped countless thousands of people during the pandemic.

Um, and it, it really just, I mean, telemedicine in general was, was out there during the pandemic, which, uh, it was a good thing because it, uh, it helped thousands of.

Brett Shoemaker: Help people really get into understanding that technology doesn’t have to force you to be in the same room with somebody and allowed what I believe from a business standpoint, create more efficiencies overall.

Would you agree with that?

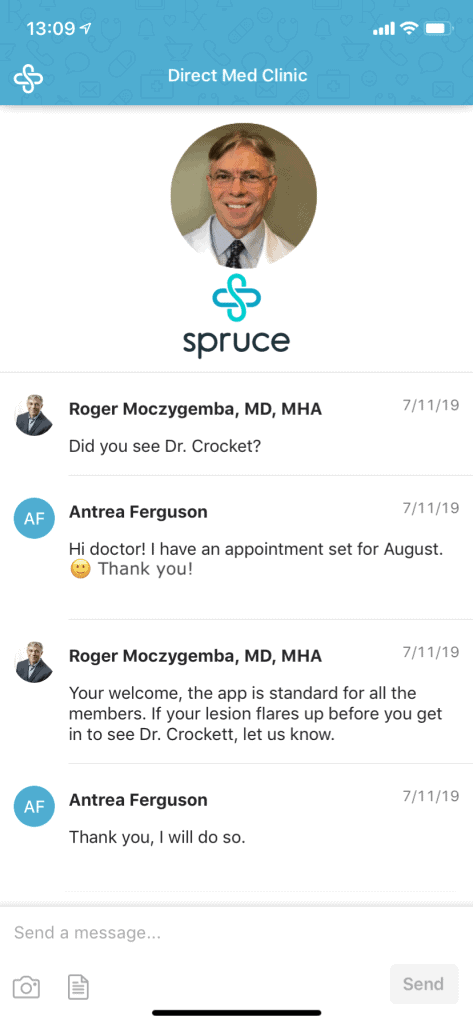

Roger Moczygemba: Yes. Let me just say it this way. It’s not so much technology, but it’s access to care, access to a doctor that is allowed to use technology. The reason I say it that way is that technology is just a tool. I mean, the real magic is, is really with the contact.

It’s the access to the doctor. Now the doctor knows how to take care of you, and they’re going to know what kind of technology will work and what kind won’t. You know, whether a text message is enough or a phone call or a virtual one like they need photos or they need a video visit. And so it’s really about access.

And to say it another way, several years ago before the pandemic, I was at an American Telemedicine Association Convention and somebody said something that stuck with me. That our technology has far outgrown our reimbursement strategies or reimbursement mechanism. And that’s really what we’re talking about.

If you recall during the pandemic, those regulations were relaxed, allowing people to call their doctor on the phone or talk to the doctor on the phone, and then the doctor bills for that and get reimbursed. Otherwise, there were doctors who just wouldn’t have had, the ability to talk to their patients and get paid for it.

The Growth of Direct Primary Care and Direct Med Clinic

Brett Shoemaker: So even though the pandemic obviously created a lot of lives lost, unfortunately, our prayers and thoughts go out to all those families, but there’s a lot of things that I think laid the groundwork for where we’re at today. And I don’t know about you, but I’m feeling a sense of urgency and a vacuum almost that’s being created because employer groups are starting to understand that there is a difference.

And it’s really forcing insurance brokers and employee benefits brokers to start to educate themselves versus us pulling people along and dragging people along. Now I’m noticing that people are raising their hands and saying, Hey, we need to have this conversation. Let’s talk.

Right? I don’t know if you guys are seeing the same thing.

Roger Moczygemba: Absolutely. We’re living that right now. And part of it is because the word is getting out. Another part of it is because of transparency. I’ve heard in the last couple of months, two fairly sized fair-size employers tell the brokers, Hey, we want this.

ou look at a way to make it happen.

Brett Shoemaker: Figure it out, right? That’s where we come in because we laid the groundwork, and I say we, but, really and truthfully folks like Dr. Goyle and yourself. You talk about you being an innovator and entrepreneur. I would consider you a businessman because not only have you gotten past almost five years doing this, you’re up to what, multiple locations now.

You’ve got two physical locations, is that correct? And then also some near-site onsite clinics. So you guys are rocking and rolling.

Roger Moczygemba: Right. Yeah. Part of our model, well part of our operation in San Antonio is a couple of locations, and then we have a part-time onsite location, and then for one employer, we function as a near-site clinic.

So I think we kind of got the continuum coverage.

Healthcare Vs. Health Insurance

Brett Shoemaker: Absolutely. I am so excited to see what you guys are doing and the continued growth and I know you’ve got a great marketing team behind you, with Shankar and all of the great things that they’re doing for you guys, and so just a great partnership’s, been great getting to know him as well, and so let’s dive in here, Dr. Roger. Healthcare versus health insurance.

What would you say to the people that are out there listening? Any employers, any, even maybe employees, or just everyday average folks that are looking for healthcare. What would you say to them about why healthcare and health insurance have been misconstrued over the years?

Roger Moczygemba: We’ve mentioned there’s a difference here. I would just invite everyone to think for a minute the next time they hear anybody talking about healthcare. Think in your mind, are they really talking about healthcare or are they talking about health insurance?

Most of the time these days when people are talking about healthcare, you’ll find that they’re really talking about health. Now to answer your question, health insurance is what’s expensive. There are the high premiums, there are the high deductibles, and all that, but once you learn about direct access to the doctor, like direct primary care, or if you’re an employer direct directly contracting with a clinic.

You’ll see that healthcare is not that expensive. Access to a doctor or a clinic is not that expensive. It’s self-insurance, which is expensive. So in, in our situation when a direct clinic directly contracts with an employer, we essentially are partnering with them and through. Kind of direct agreement or partnership agreement.

Now we are able to offer them cash pricing on imaging, which we have available to us, and our rate on labs. And so we pass that on to the employer and so the employer doesn’t have to go through. The employees at that company don’t have to go through their insurance where there’s a markup on all of those services, which is, can be pretty substantial.

Brett Shoemaker: Absolutely. The amount of savings on imaging and labs is just unbelievable. I remember when I first started, looking into the pricing, when I got involved in the healthcare industry about 18 months ago, I was blown away at seeing the cost of labs and imaging, and many times, you know folks end up, What is called co-insurance, right? And most companies are 80-20 co-insurance. And what I found astounding is that the 20% co-insurance that folks were paying in most cases, not only was more expensive than what it actually costs, a lot of times just their co-insurance was two and three times what the labs or the imaging actually cost before the big insurance companies got the rest of the cut.

It’s just unbelievable. Isn’t that?

Roger Moczygemba: It really, is it really gotten out of hand?

Brett Shoemaker: Yeah. I mean, you know, we have a slide that we show employers when we’re showing direct primary care and the benefits of it. think it’s like $1,400 what it was costing through being built through insurance.

And after we applied our discounts, it was like, I think 140 hundred and $50. And when you think about that, I mean, it’s literally 10 times. Mark up what the insurance companies are charging versus what it actually costs. And not only that but as you to your point out, we shouldn’t be using health insurance to handle our healthcare.

We have car insurance to cover our car in case we get into an accident, but we don’t use our car insurance for an oil change or tire rotations, or regular vehicle maintenance. And at the end of the day, everybody needs a relationship, like you mentioned, that access, that time with a doctor so that they can get their healthcare, which is actually that preventative maintenance and that ongoing maintenance like you would on your vehicle.

Right?

Roger Moczygemba: Yeah. And let’s just take that analogy one step further. Let’s say that we used our car insurance to change the oil. Now if I’m on a limited income and I’ve got my car insurance, I might get to the mileage mark or the time mark that says, Well, I need an oil change. But wait a minute, I’m running tight on funds this month, so I’m gonna put that off.

My car’s running fine. I don’t need to change the oil right now. So you go another month. Another month, and you don’t take care of the maintenance on your vehicle until you go on a trip or so. And it breaks down, where the motor seizes up. Wow. Then it’s gonna be a huge expense for you.

So that’s a similar analogy to what happens in healthcare. When people don’t have affordable access to care because they think that the only way to access a doctor sometimes is with health insurance. And it’s sad to see that it’s turned into that. I think there are going to be a lot more direct primary care doctors, and that’ll be great, and positive for everybody to know that they don’t have to put off their healthcare.

They can go in and not wait for the last.

Resources for Direct Primary Care Advocates

Brett Shoemaker: Absolutely. And so Dr. Roger, one of the things I like to do on this podcast, for employers and for individuals that are out there listening brokers, whoever it may be, is really share with them resources. you and I both know that at the end of the day, we could give you all of the resources, but you really need an advocate.

You need somebody. And when I say somebody, I’m talking about a primary care doctor that is practicing medicine in the direct primary care model because they’re the ones that are going to use and help steer and guide you to that best and most affordable care. I just had Dr. Dickerson on with Green Imaging and obviously, there’s another broker that I was in conversation with, a good friend of mine named Crystal Wilson, and she was talking about some lab resources that she uses.

What are some of the resources out there that you would say to listeners?

Anything that you would like to share?

Roger Moczygemba: Green imaging is definitely one of those. Most DCC docs know about Green Imaging and employers should know about that too, brokers should know about that. Another resource that many DPC doctors use is an internal consultation service where if we are getting to an area where a patient’s care might be complex, and bumping on the edge of meeting a specialist, we can reach out electronically to a specialist, through this service. And then within a matter of a few hours, we get a response back from the specialist giving us some guidance on what to do with that patient.

So in that case, you see having access to your direct primary care doctor can keep a patient from having to go see a specialist, which would be usually another big out-of-pocket cost and entail probably a lot more testing on their part. So that’s another resource.

Is Direct Primary Care Good For Emergencies And Catastrophes?

Brett Shoemaker: I appreciate you sharing that, Dr. Roger. Now let me ask you this because you know when folks start hearing and they hear about Direct Primary care and they hear all of the deliverables and what they get out of it, and they see the concierge level access that they have, they start to wonder, and in their minds, they think “Wow, well, I don’t have this insurance card anymore.”

Like how in the world is this gonna cover me for those big, bad, ugly things? And so obviously you and I know there are different health shares out there, medical cost sharing, utilities that are used. And not only that, but you can piece together a DPC doctor as the foundational coverage on your health plan when it comes to standard sick care and ongoing health coaching as well.

But what would you say to those folks out there that start to get a little nervous and they’re like “I want to make this shift. I want to make the change.” What do you share with employers in terms of these challenges that I’m speaking of?

Roger Moczygemba: If we’re posing that question for an employer’s benefits program, I would say that they need to be in with a knowledgeable broker because that’s their job, it is to know what resources are out there to put in place after the DPC core or around the DPC core.

Many brokers are incentivized by large insurance companies to keep a company fully in a model, so it might not be in their best interest to do that, but it’s definitely in the best interest of the company for a broker to deconstruct that fully insured plan and customize the approach that’s gonna work best for the company.

Some brokers might just not know how to do that, or they might not have the background with the resources, but there are resources. So it needs to be a knowledgeable broker.

How To Go Self-Funded With Direct Primary Care?

Brett Shoemaker: Absolutely. That couldn’t be any further from the truth of what you’re saying, you have to have a knowledgeable broker.

And I think a lot of times companies when they think about self-funded or level self-funded, they get a little bit scared because they’re thinking “That means that we’re going to be footing the bill.” And the reality is, even when they’re with a carrier, they’re pretty much self-funded because they’re still responsible to deliver that care.

Do you want to elaborate a little bit on that and share with employers that are listening why it’s not really that scary to go self-funded?

Roger Moczygemba: I’m not a large employer, but I can definitely appreciate their position because if you have, a lot of people are in the mindset like “I want my Blue Cross card, or I want my insurance card,” they have to take care of their people and their people have to perceive that they’re being taken care of too.

They shouldn’t have to worry that much about healthcare, and we all know how complex. The best thing that an employer can do is to know that, number one, there are options out there, and then to look for the right people to explore those, like an experienced benefits consultant or broker. And then another thing is to get to know a DPC doctor in the area or in the areas where your employees are and to explore or start a relationship with that DPC doctor.

I say this to open your mind a little bit and then start taking some baby steps. We’re not asking somebody to just throw mud against the wall and see what sticks. No. You know, when employers gotta be careful about taking care of their people, but what they’re gonna find more value with each little baby step they take. And the more they take, the more they’re comfortable with that, they’ll take a bigger step and then they’ll find more value and they can work it in.

Does Direct Med Clinic Accept Insurance?

Brett Shoemaker: Take the baby steps and with every baby step there’s gonna be value. And you could not, again, be any further from the truth because here’s the reality, once they start exploring what it looks like and the level of care that they’re going to receive, then they start saying “Wow.”

I think what happens, Dr. Roger, from my experience, is when these employers actually peek behind the curtain and see what their people are going to get and understand all of the cost containment strategies that are really implemented just by the very nature of direct primary care, they start to connect the dots and say “Wow, we have got to figure out a way to do this because our people need this.”

I just love the fact that we’re able to deliver care on that level.

You guys practice and how you do it, there in San Antonio. Do you guys accept any insurance at all? Are you guys 100% subscription-based?

Roger Moczygemba: I kind of alluded to the way that we got started and it was gonna be patterned after for another practice.

So the way we got started was as a hybrid. That means we started out taking insurance, and we still do just for a handful of people because they started with us, but we we’re not taking any new insurance. That’s not part of our model. We’re all direct care basically.

Dr. Roger’s Driver To Deliver Better Healthcare To Americans

Brett Shoemaker: I love that. I absolutely love that.

So you guys are practicing what you preach. I can’t tell you how much I appreciate you guys for doing what you do on a daily basis.

So you have a pretty fast-growing team over there in San Antonio, and you guys are obviously doing some great work. What would you say, Dr. Roger that is the thing that gets you up out of bed every single day and to go and practice medicine the way that you do? What do you think is the biggest driver?

Roger Moczygemba: That’s a great question. No one’s asked me that before. I feel so energized these days in my career because there’s a wonderfully refreshing way to practice medicine where you can slow down with each patient that you see, talk to them, and spend time with them, and then it’s affordable and accessible.

I love just talking about that, and I do a lot of extracurricular stuff outside the clinic because I’m so excited about it. I just want to spread the word, I think because I’m kind of an innovator and entrepreneur at heart. That’s, that’s how I met you, that’s how I got connected with Free2Care, and that’s why I do all these other things and I’m out talking to employers and, and people all the time about it.

And so what gets me out of bed and motivated is just this wonderful model and taking care of people. A couple of months ago, I was at the clinic and a patient was checking out, who’d seen one of the other clinicians there, so he looked over and said “Hey, Dr. Roger, I’m glad that you’re here because if you wouldn’t be doing what you’re doing and have this clinic, we wouldn’t have anything.” It’s that kind of stuff that is really heartwarming.

And then another thing that when the pandemic was winding down, we were looking back at some statistics and we, we look on this one employer that we have and we were really tight with, and told them “Look, if you have anything COVID-related or respiratory-related, let everybody come to us or let us manage that.” And when we looked back on what happened, nobody from that company got hospitalized. So it’s that kind of thing that motivates me.

Recent Comments