- Welcome | Opening Remarks | Shankar Poncelet

- Introduction to Speaker | Dr. Roger Moczygemba

- Keynote Speaker | Seth Denson

- Q&A Session | Question by Dr. Arti Thangudu

Welcome | Opening Remarks | Shankar Poncelet

Shankar Poncelet: Good evening, everyone, this is Shankar Poncelet talking to you. I am the co-founder, along with Dr. Roger Moczygemba of the San Antonio Free Market Medical Association chapter, and I am very, very excited to welcome you to this second quarterly meeting that we have tonight. We have 23 participants here tonight, so we managed to bring together a great group of people. I will ask everyone also to consider sharing the Livestream. I’m going to share the Facebook page of the Free Market Medical Association here in our chat so you can go and share that Livestream not only to the world but to everyone outside that is interested, so here is the Facebook page.

Alright, before we get to our speaker of the night, Seth Denson, I want to briefly talk about what the FMMA stands for and introduce the organization to you all. The FMMA is interested in talking about pricing in healthcare. A lot of you might want to get a specific price for seeing a doctor, buying medical equipment, or buying medication. It can be very tough to do that. But how cool would it be if we could go to websites, where providers, and other actors of the marketplace, would just show what their pricing is for a particular service? This is the case slowly members of the FMMA and other like-minded people put that out there the FMMA may also have a Shop Health website where you can go and shop for services, lookup services, and get pricing today.

I’m sure Seth will address this in his speech, but today was also a huge win where hospitals didn’t want to show their pricing, and there was a legal battle, and it was ruled that hospitals do have to show their pricing. So that is a great win for this movement. Now, once you have pricing you also want to get value.

I want to touch upon what value means in this paradigm briefly. Value, for example, means that if you go and finally see a doctor, the doctor will take the necessary time to talk with you. We know that there is a standard of 15 minutes, but sometimes 15 minutes is not enough, and we just want a little bit more. That is possible if we have a different mindset. Similarly, access to a provider to medication is also not a given. Just because you have a card that makes you part of a network doesn’t necessarily mean that you have someone close to you that you can go to and ask for help or doesn’t mean that you have someone that can help you in a timely fashion. Now, last but not least, we want also to mention that equality is fundamental to us. We want to make sure that if someone is willing to pay cash for a particular service for a specific product or medication and that is accessible to you no matter who you are and no matter what card you may have in your pocket.

Now at this point, I will see if I can hand over the virtual stage to the co-leader here in San Antonio, Dr. Roger Moczygemba. Dr. Roger, the stage is yours.

Introduction to Speaker | Dr. Roger Moczygemba

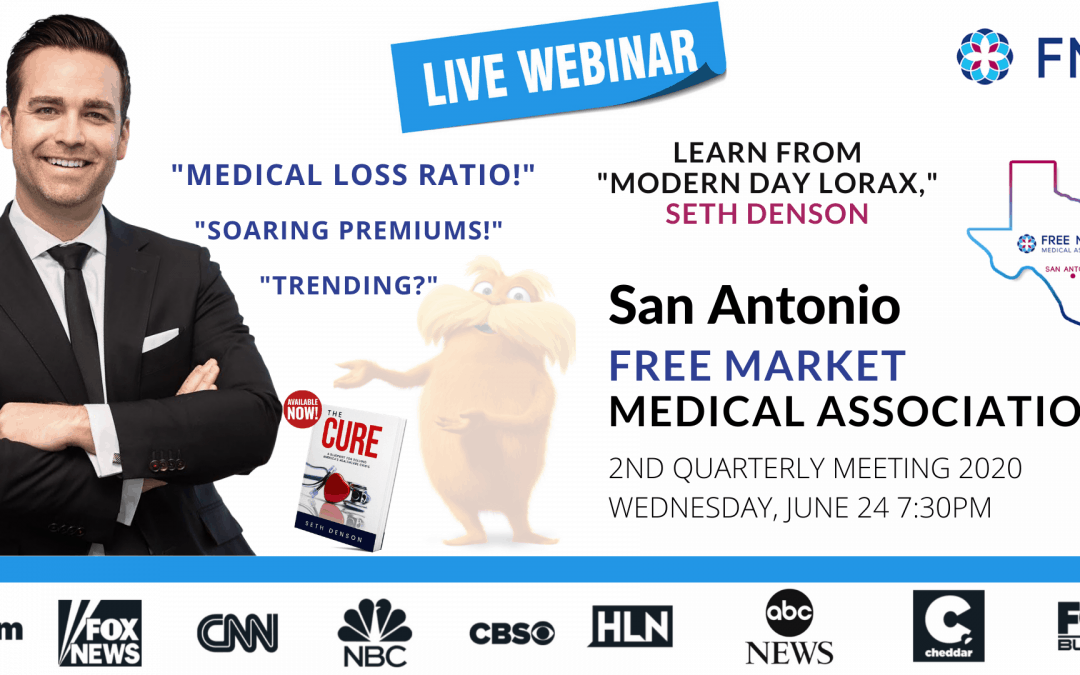

Dr. Roger Moczygemba: Thank you, Shankar, can everybody hear me? Yes. Okay great. So I am so glad to have Seth. I present Seth Denson to you guys. Seth is not your average broker. Through his childhood in West Texas, he’s had many personal interactions with doctors that shaped his view of our healthcare system. Now, he’s a financial and healthcare analyst in his book, “The Cure,” he rightly points out that driving down the actual cost of health care is essential to making it affordable. Seth wants all Americans to be critical consumers of health care and therefore holds all parties responsible for their costs. So this is why we are so honored to have him here as our guest speaker tonight since that is what the Free Market Medical Association is all about. So he is here to help us in this area create our own local, free health care market through price transparency, understanding the terms associated with benefits, and what we might expect from insurance in the post COVID world. Seth is always on Fox, CBS, NBC, and NBC, so we’re honored to have him here with us tonight. He’s also a consultant to many private companies. Seth, thank you so much for taking the time out and being with us to help us here. The virtual floor is yours.

Keynote Speaker | Seth Denson

Seth Denson: Excellent. Hey, thank you for that introduction, doc. I appreciate that and how great it is to be with everybody today, coming to you from Dallas, Texas.

Thank you for the opportunity, and thank you for taking the time this evening because I recognize we all have a lot going on, and to take some time out of your evening to be part of this is very important. I got asked the question when I wrote my book, “The Cure,” what my ultimate goal was with the book. I said that my goal was that I wouldn’t have a job because of my book. What I meant by that was our healthcare system needs reform and my hope is that we at some point come to a place where there doesn’t need to be a market analyst consultant anymore and for the other broker and consultant friends on the line I’m sorry I’m trying to talk to you out of a job too! But I really hope that we can come to a place where our healthcare system operates like every other aspect of our consumer life and that was the motivator behind the book. I wrote it, and throughout the wee hours of the morning following the Republicans attempt to repeal and replace. If you’ll remember, there was a Skinny Repeal bill, which I liken to a skinny margarita. A tasteless watered-down version of an original bill that had no value or substance, and that’s not a political statement, that’s truth. The Skinny Repeal would have done nothing to solve for healthcare. It would replace the Affordable Care Act with something equally as bad that sounded good on the talking shows on Sunday morning but, in the end, did little to solve the problem within healthcare, and so what I hope we’ll do this evening.

I’m eager to engage with you in conversation through the chatbox. Let’s talk about that, let’s talk about what we’re seeing in the market now, let’s talk about the hopes that I have as we enter into this new era of health care, which I think a post COVID scenario will provide us. I was thrilled yesterday with the judge’s ruling that the hospital systems indeed would be required to provide transparency to their pricing systems. That was a great first step. I’m equally disappointed that at the end of the day, the fine for non-compliance is $300 and that’s roughly a box of tissues in a hospital room billed charge. So if you think about it, for a hospital not to comply, they’ll have to pay a penalty of a little over $100,000 a year. That is not even a drip in the bucket to many of these conglomerates. That being said, let’s not down the bad with the good. The good is that we’re moving in the right direction. I was very pleased with the executive order originally; I’m pleased with the judge’s ruling, and I’m hoping that this will move us into the right step. What I thought we would do today is we’re going to talk through some term and terminology. Now if you’ve been in my industry for as long as I’ve been in my industry you will realize that it’s quite the alphabet soup of acronyms and terminology. I’m going to outline a few of the terms and terminologies that we’ll discuss tonight and really try to provide you with some context for what those words and acronyms might mean.

The first is the word “trend.” Now trend is just a fancy industry word for inflation. There are two types, and by the way, inflation is not like we would be used to it in a CPI where there’s actually data and statistics, rather inflation based on the healthcare industries decision to go, “Yep! I think we’re going to increase costs.” So there are actually two types of trends that we see in the healthcare space. There is true medical trend in which there are independent studies of true medical inflation. This is the actual increase in cost. So an annual inflation and medical would say that if I had $100 procedure done today, 12 months from now, what would the true cost of that procedure be? Now, medical trend in the United States by and large over the last decade has increased somewhere between the five and seven percent range and that is medical trend.

Health insurance trend is something totally different. Oftentimes, we in the healthcare space try to blend those two but they shouldn’t be because health insurance trend is even more arbitrary and it’s based on Wall Street. What health insurers do is they will take the true medical trend and then they’ll compound that with all the layers of fat that they need to put into health insurance premiums to make sure that they are generating more profit.

Now we’ll talk about that at length at some point today. Again, I am NOT here to demonize the insurance industry. I’ve been part of it now for nearly two decades but I am certainly here to demonize the health insurance industry as I’ve been part of it for nearly two decades. We’ll do some of that today as we talk through it. I will tell you that I have not been invited to any insurance company Christmas parties in the last few years and quite frankly, I’m ok with that. I’ve got a lot of friends in the insurance business that focus primarily in the old way of doing things and I don’t blame them one bit there’s a lot of money to be made in it. That being said, we’ve taken a little bit of a turn here and most of the brokers and consultants that are on this ZOOM call today I know and I know that they’re ones that have decided to take a different turn as well and I’m pleased to hear that but we’ll talk about that.

So trend, when we talk about it we will certainly define it as either a medical trend or insurance trend another acronym. We’ll talk about what’s called MLR ‘medical loss ratio.’ Now this was a key provision found within the Affordable Care Act and while we’ll talk a little bit more about its involvement through the Affordable Care Act and what I would consider to be the fallout from the MLR. It is effectively the way by which insurance companies under the law are required to spend your money.

The standard MLR mandate found in the Affordable Care Act said that insurance companies have to spend approximately 85 cents of every dollar that they collect on claims.

It’s a little bit less than that for community-rated small groups planned; it’s actually closer to 80% in that world but that in effect was that big part of the law that was going to reign in big insurance. We’ll talk a little bit about how maybe that isn’t quite doing what we had hoped it would do. Another term and terminology would be what we considered to be ‘pools’ or pooling points. A pool is the way by which an insurance company has created the largest legal Ponzi in the United St–already told you I was going to demonize the insurance industry so you shouldn’t be surprised by now but health insurance specifically the pooling structure of health insurance is the largest legal Ponzi in the United States. Effectively, it is a way for an insurance company to balance the scales and manage their losses. Again, I’m ok with this. This was actually the fundamental structure by which insurance was intended to be where a group of people would pool their resources, put money in a pot, and when somebody would need, if they’d stick their hand in that pot they’d go get that money. It was actually the first official employer-sponsored plan in my hometown here of Dallas, Texas, where a group of nurses from Baylor Hospital came together in the early 1900s and said, “Hey, let’s do something about this. Let’s share some resources.” Thus, Blue Cross was born. It’s not quite the way Blue Cross works today, but that’s ok they’re nonprofit, right? Anyway, so we’re going to talk about a pooling point. That is effectively the pool is the collective sum. So in every health insurance policy in the United States, there are three key components.

There are administrative costs, and that’s the amount of money that it takes to process a claim to keep the lights on, to print those pretty little white ID cards we all carry around like safety blankets. There is claims. this is your everyday stuff this is everything from Lipitor to Johnny sprained an ankle and needs an MRI. Suzy needs a flu shot and then there’s what we call ‘the pool’ and roughly on average, and this can go up or down based on group size, and experience about 30 to 40 cents of every dollar that you spend on health insurance whether you are in a group policy or whether you’re an individual is going into the pool or as we like to call it ‘the Ponzi.’ The pooling point is the amount of claims that need to be incurred before effectively the rest of those funds that are set aside to fit claims a cease and instead that claim is then paid out of the pool. Now, why does that matter and we’re gonna talk about that here right now, the reason it matters was right after the passage of the Affordable Care Act the health insurance lobby rushed to Washington and they lobbied Congress. As they were putting that bill together, remember, this is a bill that was over 2,000 pages and since has had over 11,000 pages of regulatory additions added to it so the health insurance lobby rushed to Washington and they said “Hey, this MLR says that we need to spend 85 cents of every dollar we collect on claims there is feasibly no way we can do that and remain solvent because if one group has a horrible year and we end up spending 400% of every dollar we collect, but other companies have good years, we’re going to give them all their money back and we won’t be able to use that money to help offset the loss,” and they’re right, and so Congress in their infinite wisdom, however, gave them a trump card.

There’s no pun intended that they did it long before the current president, the trump card was this that the pool didn’t apply to the MLR on a specific basis so in every edition, every company that is rated the MLR was not based on that company’s performance rather the pool as a whole and so insurance companies found a new way to move money around where it needed to go to make sure that they didn’t have to give you any of that money back and that’s just the way that the Congress works sometimes and so pools and pooling points are important to note. Every company is pool. It’s very rare for a company that buys health insurance not be pooled with other companies that are like them in some way shape or form are pooled with companies. However, the insurance company deems the pool necessary and then that pooling point is a mathematical calculation the other in terms that we’ll use, we won’t break down the different types of health insurance much but to just to overly simplify this I want to tell you now there are only two types of funding mechanisms in the insurance world. There is self-funded and there is fully insured. That’s it. So I’m always interested when I talk to them like, “Oh, well you know we’re partially self-funded.” No. You’re self-funded. “Oh, we’re level-funded.” Mmm You’re self-funded. There are two types under the government regulatory structure of health insurance plans from an employer perspective. Those that are self-funded and those they’re fully insured is Ronco set it and forget it until renewal comes around I’m giving you my money and you spend it as you see fit self-funding is, “I’m taking a component of that risk but I likely have some type of reinsurance level funded-graded funded.” All these different structures are all part of a self-funding under ERISA platform. So there hopefully we’ve cleared that up for you.

Alright so there’s the terms of terminology hopefully that makes sense I’m seeing some comments coming through although I’m getting to the age where I can’t read them anymore and Andrew hasn’t yelled at me so I’m assuming there’s been nothing overly pertinent and I’ll need to make sure to address so before we get into it, I thought I want to just kind of share a couple things about me and Dr. Roger did a great job of providing a bio. I’m always amazed at the different bios that I get to hear about myself and it’s always somewhat humbling and to hear really cool things talked about but I’m going to tell you about the really coolest thing about me is I’m a dad to Emerson Arabella and Connor and I am a husband to Jenna and by the way if there is ever a question about my ability to sell all you got to do is meet my wife Jenna and you will realize that I may just be the world’s best salesman as we say in Texas here: I certainly out punted my coverage.

My intra into the healthcare space was probably not much different than many. I did not grow up saying, “I think I want to get into health care from a perspective of health insurance and the financial metrics analytics world.” Matter of fact, I thought early on I wanted to be a major league baseball player. Sadly, I didn’t have the talent for that but after I changed my major about five times my freshman year of college I had my guidance counselor pull me aside and say, “Seth, what is it that you want to do with your life?” and I said, “I don’t know Ms. Reed. She said, “What do you like to do?” I said, “I really like to play golf” and she said, “Well then why don’t you go down to the local golf course in the middle of the week in the middle of the day and ask people what they do for a living that allows them to play golf on a Wednesday in the middle of the day” and much to my surprise, they were on the financial services and healthcare health insurance world and therein was my intro into the healthcare space.

Now not to be outdone, I certainly did think for a time that maybe I wanted to get actually into the healthcare delivery field until during my first job as an aide in a medical center I lost my lunch early on when I saw some things that quite frankly my stomach wasn’t prepared to see and I realized that I could never be a doctor or a nurse or a practitioner or pretty much anything that had to do with actually delivering health care and so I stuck to the financial side of things and for the first decade of my career it was a good one. I worked for brokerage firms for national insurance carriers I worked in underwriting, and in sales, and in analytics and account management. I kind of bounced around and got my feel for the lay of the land.

In 2011, I had what my friends and colleagues call my Jerry Maguire moment. You know that moment where you, if you’ve seen the movie, where the sports agent realizes that maybe the work he’s doing isn’t the world’s greatest work and maybe he’s not leaving his positive of an impact on the world as maybe he’d like. That’s when I decided to make a change and do really what I’m doing now. I left the firm that I was with and launched into what is now GDP advisors and really started working towards doing what you’re here doing how can we make healthcare different. At least the experience is different because health insurance and health care are two totally different things. We’ll talk about that here in just a moment but what was great about that was is when you start to follow your passion and you’re making an impact really cool things happen I woke up one morning and a few years ago just kind of doing my normal thing I’m an early riser I tend to get up about 4:30 in the morning and I like to read medical briefs. I tell you I am not fun at parties but I actually enjoy reading medical briefs and different things and I was reading something and one email popped up and it was a news producer and it was just announced that Amazon, JP Morgan & Chase, and Berkshire Hathaway were going to do something about tackling healthcare in the United States and this specific producer was scrambling around trying to find anybody that might have any idea of what they were going to do and so I got an email early that morning I responded to the email. I didn’t know this person but they introduced himself via email and said, “Do you have any idea of what’s going on?” and it was a link to a CNBC article and I did. I had a fairly good idea of what I thought that those three giants would do. So I wrote a response.

I sent the response in and by 10 a.m. that morning I was on Fox News didn’t even know I was going to be on Fox News until my assistant came in and said, “Hey, somebody’s on the phone for you,” and it happened to be Fox News. Did about a five minute interview they hung up and it was kind of one of those like, “What just happened here?” Since then, and that was I think 2017, I’ve done somewhere in the range of 500 media spots that’s led to my opportunity to get to do a TED talk and then write my book, “The Cure,” and it’s been a lot of fun and I get to tell my message and it’s the best part about this is when I get home to Mrs. Denson. I’m done talking about health care for the day so she’s pretty pleased that I get to talk about other things once I get home. But that is me and that’s my background and that’s what’s led me here to get to speak with you fine folks today so let’s set the table here real quick for the next few minutes as we talk about kind of where we are from a healthcare perspective how we got here and maybe where we’re going and where we’re going has shifted at least my thoughts have shifted on this in the last little bit in large part because of COVID and while COVID has been certainly a tragic thing to hit our shores and in the world my hope has an eternal optimist is that we’ll open our eyes and maybe we’ll start to approach health care differently as a result we’ll talk about some of those things here momentarily.

We have a belief here in our office that if you want to solve a problem you have to first identify it. We don’t have a health insurance problem in the United States that may come as a shock to many of you the health insurance industry is just the credit card to the healthcare system so if I said we had a health insurance problem I can akin it to the same thing of me saying we have an American Express problem or a Visa problem or a MasterCard problem. Certainly, there are problems that are exacerbated by those things, debt being one of them, but at the end of the day we don’t solve spending habits by changing credit card companies, we solve spending habits by changing what we’re spending money on. So if we really want to start to solve the problem of healthcare in the United States which is different than health insurance we need to stop talking about them synonymously. They are not. They are certainly one linked to another but they are not the same thing. Health insurance is how we pay for what we get health care is what we get and so as we start to think about what we need to do as a society to start changing that. I am a huge proponent of the free market. I’m a capitalist. I do not believe that a government-run system is the solution to our health care woes. That does not mean that I don’t think the government needs to be involved.

Anytime you have more than one person you need rules and you need somebody to enforce those rules and fortunately, the United States government historically when it comes to consumers has been very good at making and enforcing rules, unfortunately, it’s really bad about it when it comes to health care and so when I sat down and wrote, “The Cure,” it was meant to be written for Congress. Now I wrote it in a way that my six-year-old I hoped would understand why? Because it was meant to be written for Congress and I needed them to be able to understand it. It’s roughly 140 pages long and somebody asked me, “Seth, how in the world would you be able to solve health care in 140 pages? I said “Well, certainly 2,000 pages on top of 11,000 pages of regulation didn’t do it so let’s go shorter. Maybe that’s better.”

In addition, nobody on the earth wants to read a 500-page book on health care. Sorry Marty, I actually like, “The Price We Pay,” I’m just joking. It’s a great book and I’m actually a little intimidated by the fact that I’m the first speaker since he spoke to you. I’m a big fan, so again, as we think about health care, we think about the solutions to solving health care in the United States. I think that and we’ll start tying in the coronavirus into this because this comes to a different place as we start thinking about it our problem in the United States when it comes to health care can be summed up in one word: Okay maybe two: COST. Or dare I say, PROFIT. That is the sum of the problem. Now again, I prefaced that, don’t forget, by saying I’m a free-market capitalist. I’m a big fan of profit and I run a for-profit organization. That being said, my consumers that buy my product, I want them to feel like they got a good deal. And certainly if you’re someone sick with a medical condition and you came out of that medical condition better, you very well might think you got a really good deal. But by and large, we as Americans and as consumers, at beginning the raw deal of what consumers could be getting in the healthcare space for going on the better part of half a century.

So if we start to unpack the healthcare system and how it operates we need to start identifying where the cost and the profits are certainly the judge’s ruling yesterday hopefully will start guiding us towards that sooner rather than later. Now there’s been some positive impacts that will come out of COVID, in my opinion, that will help guide this, and we’ll spend some time here in a minute talking about where healthcare really operates from a health insurance perspective, though I will tell you this: There is only one way to reduce health insurance premiums: you reduce the number of claims you’re consuming or the price in which you consume those claims. That’s it. It’s really simple, right? And so, as we start to think about how we’ll do that we’ll talk about that as we kind of go through the next few minutes here the impact of COVID though to our current climate and marketplace I think will be interesting. In the short term, health insurance companies have seen a windfall from the coronavirus. Think about it. You’ve been sitting at home, I’ve been sitting at home, the country’s been sitting at home. The CDC made it regulatory that hospitals, doctors, and providers had a hard time providing care unless it was considered emergency care. When I think of elective procedures I think of something very different than what maybe the CDC considers to be an elective procedure. Effectively the CDC says an elective procedure is anything that’s not an emergency procedure or life-saving.

So as a result, Americans by and large are sitting at home they’re still paying their health insurance premiums and so an insurance company needing to manage to an 85% MLR is it projected by and large statistically by the end of the year to be running in this 60s to the low 70s. Now before you run to the mailbox looking for your rebate check, let’s prepare ourselves for what really might be coming but the reality is if you’re in a position to negotiate the cost of health care for your company and negotiate the cost of health insurance you’re going to need to be taking a look at two very different things health insurance trend and healthcare trend. Health insurance trend by and large increases at a rate somewhere between 9 and 12% on average, so if you’ll remember earlier, I said healthcare trend increases between 5 and 7%, so tack on another 3 to 4% and there you have health insurance. Hey, we got a lot of mouths to feed in the health insurance industry. There’s a lot of administrative costs that go into printing those ID cards.

That being said, we can expect that health insurance trend for this year probably won’t be as bad as maybe we’ve seen in the past. Healthcare trend, I fear in 2021, will go up and it will go up exponentially in my opinion. And it will do that because by and large, healthcare companies, the delivery system, has been sitting at home not able to provide the care they need and as a result their costs were not generated thus their profits were down. And the healthcare industry will look to trend to help increase those costs and generate more profit in the year 2021. Now why is that important? If you are a self-funded employer, you will need to start thinking differently about how your self-funded plan is structured.You may want to think differently about that insurance network, you know, that discount that we all love–by the way, discounts don’t matter. Prices do. I’ll give you a 99% discount if you let me set the starting price so we need to start diving into the actual cost of health care and how it’s delivered. From a fully-insured perspective, likely you will have some leverage points. Insurance companies, by and large, will not want to write rebate checks this year.

Rebate is obviously the provision under the Affordable Care Act that says if they don’t spend that eighty-five cents, they got to give it back so they’re not gonna want to do that. So likely, health insurance companies are already scrambling on the fully-insured side, specifically here in Texas, but certainly throughout the country with the exception of maybe a few states like New York and Michigan where insurance companies are really pushing to try to restructure their rates in 202. Now does that mean that we should expect massive rate reductions? Now I wouldn’t go that far, but certainly if you’re in a position to be experienced rated and managed the negotiating structure of your health care plan you want to keep those things in mind because health insurance trends should be down this year. Healthcare trend will be up next year. In turn, health insurance trend will be significantly up two years from now and so those are the things that you want to start thinking about as you start thinking long term.

Now as we think about the actual delivery of healthcare and what might happen in a second wave. Now personally I don’t think we’ll see a second wave, I don’t think we’ll ever see the end of it–well, not ever–I don’t think we’ve seen the end of the first wave. I think the first wave of the coronavirus is going to continue until herd immunity and or a vaccine or a combination of both have been fully implemented. Now projections are by and large that that may be February or March of 2021. Now what does that mean? That doesn’t mean a lot from a perspective of health care with the exception of it’s going to impact the way that we approach the system differently.

Roughly 90% of all API’s, these are what are called ‘Active Pharmaceutical Ingredients’ that go into the drugs that you and I take each and every day are manufactured in the People’s Republic of China that should strike fear into anyone in the United States. If China wanted to get really serious about having an overall impact economically or socially to the United States, they could do so without ever firing a shot. They just shut us off from our drugs.

For those of us that have been ringing that bell sounding that siren for the better part of a decade. My hope is that Congress and our government starts to perk up and pay attention because certainly this goes beyond a health care issue, this is a national security issue and we need to address it. 90% of the major pharmaceutical companies in the United States, by the way, which are responsible for the vast majority nearly 70% of all innovation, when it comes to the drug industry comes out of the United States, but 90% of the components that make those drugs come out of China. Only one major pharmaceutical company here in the country has the capabilities to generate API’s that’s Pfizer with I think two or three medical plants that can generate and create API’s. It’s time we start restructuring how drug manufacturers operate in the United States and we need to start looking for other ways to generate those drugs.

Now why do I tell you that tell you that? For two reasons. One, is not so that you will go out and hoard drugs like we hoarded toilet paper but you need to be aware that that might happen it’s a very high probability that if the rest of the world sees a second wave or consistent first wave of COVID-19. There is a way around antibiotics or even your standard drugs like Lipitor and blood pressure and so on and so forth, now that is not an invitation for you to go out and hoard but that is certainly a canary in the coal mine, so to speak, to be paying attention. So my hope is, again, out of every tragedy, perhaps we’ll see some good come of it certainly the federal government is now keenly aware that we have an API problem and maybe we’ll get around to solving it. Don’t hold your breath.

The second TELEMEDICINE. Telemedicine right? That thing that we’ve all used for acute care we’ve encouraged people to use for acute care if there is a positive that has come out of COVID it’s that we’ve actually finally realized that doctors are pretty good virtually or in person and they can solve some problems for us. Sadly the way in which we operate our healthcare system in the United States by and large has not encouraged telemedicine why?

Travel on back with me to 1992 when Disney’s Aladdin was all the rage and the Oregon Trail was the top computer game to be played when the United States restructured how doctors are compensated. Now I heard it said at the beginning of this that roughly 15 minutes was the go-to number right now that is based on what we call RV use or relative value units a terrible name to call a patient’s time with a doctor but effectively it was discovered likely by not a doctor rather some pencil pusher in the back room with a calculator that a doctor should be able to see four patients in an hour, i.e., 15 minutes. Now, let’s not take note that the doctor might need to spend some time with maybe some biological needs or write notes or do any of that, so by the time we’re done with that, we’re probably down from 15 minutes maybe to 10 maybe even 7. As a result, sadly, in the United States, we treat a trip to the doctor more like speed-dating than we do anything else. We don’t have time to ask our questions nor do we have the inclination to do so and sadly many doctors today are faced with what we call the “7-minute sellout” where they have to try to get in and out.

And quickly we’ll talk about Direct Primary Care here in a minute and why we think that might be a very quality solution to that problem. Nonetheless, RV are a real thing. As a result of coronavirus, insurance companies who by and large along with Medicare have set RV use have restructured the way by which doctors can be compensated for their work. I don’t want a doctor to have to work for free they should be compensated for their work and as a result no longer have insurance companies right now been requiring that a doctor physically see a patient to be able to collect and they could start using telemedicine. So my hope is that we’ll see an expanse of telemedicine I think that will do one of two things. It will give people who need it the most more time with that doctor. It’ll give chronic care patients more access roughly 90% of all of our cost in the United States of healthcare is generated by 6% of our population. So there needs to be 2 goals set forth here. The first, let’s fix the problem with the 6%. The second, let’s keep more people from getting on that 6% list or time with a doctor will do that more engagement will do that and telemedicine can help supplement that.

So as I think about what may come out of COVID it is of a keen awareness of maybe how health care is delivered certainly we have PPE problems we had a planning problem that needed to be addressed those certainly still do but at the end of the day we’ve restructured and we’ve rethought about healthcare differently over the past 60 to 90 days the other key thing that I’ve liked to see is the fact that as for now, we’re not as worried about insurance networks. I was asked one time if I was named tomorrow the Czar of healthcare in the United States what would be the first thing I would do and I said, “Well first of all, I would say, let’s not call me the Czar, I don’t like that name at all. The second thing though, would be that we would open up transparency into the system. The second thing, and I wasn’t asked about that, but I’m going to tell you now, would be to eliminate insurance networks.” They provide no intrinsic value to the health care system. They create an opaque curtain by which the health care system and the health insurance system can be in collusion. Yes, I said it. It’s a word we like to use these days in politics.

You want to talk about real collusion look no further than the healthcare industry. The health insurance industry and the hospital systems are working together and that’s allowing for massive collusion which creates increased cost. We need to remove those barriers and the biggest way of doing that is to eliminate insurance networks. Let’s go back to an indemnity type of structure where the price of an MRI is the price of an MRI. It shouldn’t matter whether or not Blue Cross, United Healthcare, Aetna, Cigna is in my wallet. You want a consumer to ask about pricing, get a clear answer, ask him to ask what the cash price is. They’ll get it. That would help us move the needle forward. It would solve for the transparency challenges that would get us on the right track. What I loved seeing as a result of the situation that we were in is, for a brief moment, nobody was worried about insurance networks, the Javits Center in New York became a makeshift hospital. No one knows today whether or not that was in-network with Blue Cross, United, Cigna, Aetna, insert name of insurance company here, and quite frankly nobody cared. And that’s the way it needs to be.

Health care needs to be health care insurance needs to be insurance, they certainly don’t need to be in conflict with one another, but they also don’t need to be the barrier by which, I understand that which I am getting in, the price and which I will pay for it and it’s time we start moving that needle forward. My hope is that with what the action that the judge out of DC took yesterday will help start that movement and that you and I together can keep that movement going. So that’s where I’m seeing the COVID world go. I think short-term, benefit in the stoploss world, if you’re self-funded, benefit in the fully-insured world, long term, increased cost, increased inflation in the healthcare space trend as we call it in the healthcare space. Short-term, health insurance trend lower long-term health care trend higher secondary long-term health insurance trend higher than that. Health insurance trend tends to follow healthcare trend so whatever health care does today the health insurance industry will be quickly behind it.

So as we think about that, let’s start talking about solutions. What can we do to combat this? Well, we can take it from two approaches: One, if you’re an employer, one, if you’re a user of the healthcare system. Likely if you’re an employer you’re both a user and a buyer but we need to come into a new level of consumerism we need to think about this differently. Sadly, in the United States, the average consumer spends 10 hours researching a car, 2 hours researching a flat-screen TV, 15 minutes on healthcare. We blindly trust people in white lab coats. Who else knows this? Hospitals know this. They understand that. That’s why now more than ever we’re seeing a massive uptick in the number of doctors that are being purchased by hospital systems. The sad fallout of the coronavirus will create more of that, I fear, because many doctors that were still independent have had a hard time financially making it through this world with the CDC telling them they couldn’t really do what they do best. That coupled with the uncertainty of the future, I fear, will create more consolidation and regardless of what the multi-million dollar marketing companies that manage hospital systems messaging tell you hospital consolidation does not lower prices.

All evidence is that it raises them and so as we think about that it’s not likely that will change which means that we need to change you and I being user and you and I the employer the people who are effectively creating the mechanism by which more than we’ll call it a 180 million Americans access the healthcare system so let’s think about what we can do to solve that. Well first, let’s recognize again, the problem is not health insurance, it’s actual health care. Health care is a series of supply chains. Those supply chains are broken into four components: inpatient services, which are hospital systems, outpatient services, which consist of everything from outpatient surgical facilities to physical therapy facilities to rehabilitation facilities to imaging centers. The third component of the supply chain is the prescription drug industry, and then the fourth component is the doctor. And so we won’t have time to go into each of the solutions in each of those areas, we’ll focus on a couple of them which I think are the low-hanging fruit that if you solve those two you likely will solve the other two.

But I do want to restate something I stated earlier. The solution is not a Blue Cross card over a UnitedHealthcare card. The next time someone tells you, “but their discounts are better,” look them in the eye and say I don’t care about discounts I care about prices because at the end of the day, there is a lot of manipulation that can go into discounts in the network world, right? Like if I’m discounting my room and board 55% but I’m allowing to be billed for every 8 dollar mucus recovery device and $125 box of latex gloves versus a 44% discount but those are bundled in, right? Again, we’ve got to get to the point where it’s transparent. Interestingly enough, if I walk into a restaurant today, or at least when I was allowed to walk into restaurants, there was a big sign above out of the doors, right? It said A, B, C, or D. If you saw B, C, or D, you probably got the heck out of Dodge right? I mean, you don’t want to eat here. You’re probably going to get sick. You need the health care system. Sadly, we don’t do that in a health care system we don’t require them to post a B, C, or D. We need to get to the point where they do that.

When I walked into that restaurant I probably found something else a menu that said, “Hey, here’s what you’re going to get. Here’s what you’re going to pay for it.” Sadly, we don’t see that in the healthcare system either and while again, I’m encouraged by the judge’s ruling, I fear that we won’t see that any time soon not likely the hospitals will comply at least not when it’s only going to cost them $300 a day and they can charge $125 for a box of latex gloves. By the way, on many hospital bills for every day that you’re in the hospital, they’re going to bill you for three boxes: small, medium, and large, whether you use them or not so next time you’re in a hospital, take the gloves with you you’ve already paid for, alright? So as we start to think about the supply chain I’m not going to spend a lot of time talking about the inpatient and outpatient services, although I think there is certainly something to be said for an MRI machine that cost $500 one day and $5,000 the next. Nobody’s loyal to an MRI machine, by the way, so don’t give me the garbage about, “I don’t want to disrupt my employees or get between them and their doctor,” to try to tell them they need to go to the $500 place to get that MRI. And by the way, as the employer under federal law, you get to write your plan document.

So the next time someone tells you, “I’m sorry, the insurance company won’t let you do that,” go find somebody else. They’ll tell you something different because you can. You’re the employer, which pretty much under ERISA says, “Don’t discriminate.” So long as you don’t do that you’re pretty good. So think about that the next time you’re thinking about your health insurance plan so the two key components of the health care system that is that lowest hanging fruit and the easiest to solve are the Pharmacy Benefit Manager prescription drug side of things and the doctor. Now let’s start with the Pharmacy Benefit Manager side. Now I know we’re getting somewhat close on time I want to pay attention to this but at the end of the day if this won’t make your blood boil it means you’ve probably already heard this. 70% of all drugs delivered in the United States are done so through a mechanism of one of three PBM Pharmacy Benefit Managers. These are the people that actually negotiate the prices of drugs, by the way, they suck at it. They’re no good at negotiating the price of the drugs, at least not in the way that they were originally intended to be in the 1960s where they charged a fee and got a better deal. These were supposed to be the Sam’s Clubs and Costco’s of the pharmacy industry instead they have become more like the loanshark on the back end that you never know what you’re getting and what you’re paying for. So there are actually three ways in which PBMs make money. They can charge a fee for every drug that’s dispensed. They get what’s called spread pricing that’s where they buy the drug here and then sell it to you here and get all the mound in the middle. If time would allow, I would walk through the AWP structure that’s the average wholesale pricing structure which the federal law allows them to operate under which is infuriating it should be illegal and then the third way is rebates. In effect, a rebate is a commission. It’s the way in which an insurance company, I’m sorry, a pharmaceutical company will negotiate with a PBM that, “Hey, if you distribute X amount of my drugs, I’ll pay you a commission.” That’s an oversimplified way of saying it, that’s the way it works. Guess who controls the formulary? You know, the drugs that are preferred versus non-preferred? That’s right, the PBM.

Guess which drugs are putting on the preferred list? Not the cheapest, the one that’s going to make them the most money and by the way when you ask them for their pricing structure they’re going to tell you they can’t tell you, ‘It’s confidential.’ Confidentiality arrangement between them in the pharmaceutical company. Next time they tell you that, go find a new PBM. Sadly, 70% of all drugs are filled by one of three PBMs those three PMS are Express Scripts, CVS, and Optimum. Express Scripts owned by Cigna, CVS, Aetna, and Optim United Healthcare. Remember without that word collusion we talked about earlier? So the reason I point that out is remember the words are the initials MLR ‘medical loss ratio?’ When these insurance companies get to write, report the amount of money they spend on claims, they get to report what they spent on your claim even though they took the money from one pocket and moved into the other because the pharmacy company, which they’re saying they spent your money on that drug, they got the spread pricing the rebate in the fee on the pharmacy benefit manager is the cash cow for the health insurance industry.

Now, fortunately, there are numerous pharmacy benefit managers in the United States that are not linked to an insurance company you want to use one of those you want to start working with them you want start engaging with them. Now there are always exceptions to the rule sometimes the devil gets you a better deal than the angel. What I mean by that is there are times where CVS, Optim or Express Scripts, because of the volume, even based on their not-so-great practices are still going to get you a better deal and that’s why it’s important to understand the data, the drugs, how it operates, so you can always make sure that you’re getting the best deal and utilizing your money in the best way. The other thing to realize is that in the pharmaceutical industry, many pharmaceutical companies have patient assistance program set up where you can actually access the drug in some cases, for free. Why not use those first? By and large, patient assistance programs go massively underused every year. By the way, you’ve heard about these before. Every TV commercial that you see on a prescription drug they’ll quick blurb at the very end where the former micro machine guy if you remember those commercials will come on and say, “Can’t afford your drug? AstraZeneca may be able to help.”

These are the patient assistance programs that are out there. As an employer, you should be looking to utilize these in and when you can for your employees because likely they can get the drug for free and guess what happens when they get it for free? So do you, you don’t use your claims dollars to pay for it so that is a quick and easy way to start looking at prescription drugs. The last thing I’ll say on the prescription drug side is there is a new trend in the prescription drug industry which we call ‘stupid drugs.’ These are drugs that effectively take two generics or over the counters, slap them together, wrap a gel cap around them, and make sure they go into your preferred formulary. So this is the structure in which the pharmaceutical industry will operate. By the way, Vimovo is one example I’ll give you. Vimovo is what it is in effect Nexium and Aleve slapped together. You can buy those two for 15 bucks. You buy Vimovo it’s going to cost you twenty-five hundred and that is being provided through your PBM likely in the preferred list. Now why in the world would an insurance company want to pay for that? Well when they’re making 20 to 30% spread on that drug and they get to use your money to pay for it so helps their MLR numbers starting to get the point? So again, we have to be more informed.

As employers, our employees are looking to us to help them navigate. You’re not getting between them and their doctor to navigate these things differently, it’s your responsibility and at the very end it’s your money the last thing that we’ll talk about is the physician who is the gatekeeper of the healthcare system. I often will refer to the doctor as the milk in the grocery store. You know the thing that we all must go to get where the milk is in the grocery store. It’s in the far back corner. Now, why is that because there’s no margin in being a doctor because there’s no margin in milk, they’re very thin. Now if they’re very thin, why would hospital systems, by and large, be buying physician practices as quickly as they can and why would a recent financial report show that their average return on investment is eight to one? It’s because that’s the sales force just like the grocery store the hospital wants you to have to go through the row of double stuffed Oreo cookies and all the other stuffs got a massive margin for that doctor you want to make sure you’re sent to that 3rd floor for that MRI. That’s 3,500 bucks versus the one across the street at the standalone clinic for 500 bucks the doctors become the sales force which is why it’s never been more important for you to engage with a doctor when the doctor that does not have an ulterior Master by which they’re telling you where to go and how to get there.

Direct Primary Care is a huge resource in the ever-growing world of patient-physician engagement in chronic care management. Remember what I said earlier? 90% of all cost is generated by 6% of the population. Said differently, we’re overspending on 94% of our population. We need to stop doing that. Let’s focus our resources on our 6%. How do we do that? Better engagement with better doctors and don’t give me the garbage about loyalty. Nobody’s loyal anymore. They’re loyal to their pocketbook. Create an incentive by which your employees can go to the doctor that you want them to go to, that you’ve engaged with, that you’ve identified has no relationship to the hospital, and has your employee’s best interests in mind. Create an incentive and they’ll go there. Create a disincentive by way of asking them to pay more and they’ll go somewhere else. So again, there are ways to think about this but it takes all of us thinking about this so we kind of start to wrap the conversation because I want to make sure we leave some time for questions. I want to leave you with just a few solutions or things to think about as you start to think about healthcare throughout the rest of 2020 and of course into 2021.

Remember that what I just said earlier 90% of the cost is generated by 6% of the population that the insurance industry along with the healthcare industry operates by and large in the tactics these two key diversion tactics are one of two things: Raise your deductible or put in a wellness plan. By the way, the consumer-driven health plan is garbage. It is now and I say that if somebody’s been enrolled in an HSA qualified plan for almost 15 years now I’m a big fan of it but most of your employees aren’t. We raise the deductible what happens they can’t afford that MRI so they don’t go get it. If they don’t get that screening, they don’t get the thing they need done, they don’t engage with their doctor, what happens? Then they become part of the 6%. This is all a process the health insurance and healthcare industry wants there to be more 6 percenters. That’s who generates profits. By the way, fun little tidbit for you since the passage of the Affordable Care Act the largest five publicly traded health insurance companies in the United States have seen stock price increases of over an average 400%. Really reign in demand, didn’t we?

So don’t buy into the diversion tactics. Wellness plans? I’m fine with wellness plans and have no problem with them but are we really trying to get well? Because 90% of the time, the people that engage, the people, they’re already healthy, right? Why not instead invest those resources and in getting your people who are chronically ill better engagement? Getting those people that could be better engagement, getting all of your employees better engagement with better doctors they’re going to guide them where they want them to go remember they’re going go where the doctor tells them to go. The American citizen is not a good consumer when it comes to healthcare. We must help them along and give them the tools to be that. The second thing everybody’s self-funded. Remember at the beginning I said there’s two types of plans fully-insured and self-funded that is a government structure by which you operate everybody’s self-funded insurance company’s not interested in losing money on you. You cost them too much money and they’re going to get it back. It’s called an amortization schedule; they’re just going to increase that rate over time.

The question is you’re going to pay your claim this year you can pay it next year or the next five years, either way, you’re paying the claim I assure you of that so why not get into a structure that gives you more control? Well first you need someone consulting you that’s going to help you take that control consulting can’t be done by a spreadsheet once a year at a renewal meeting and it can’t be done by pretty HR handouts that tell you about compliance briefings, “sir those things are nice,” but you need somebody’s who’s going to get in there and get in the weeds with you sit on your side of the table and work with your analytics by the way when I was “just a broker” we used to have a saying, “Trend is my friend” because trend gave me a 10% raise every year. You need to understand where the incentives that are aligned within the people that represent you. For you brokers and consultants there on the call hopefully you’ve already made a few move to fee-based consulting services that’s certainly what you need to be doing you need to get on the same page with your client sit on the same side of the table as them. We need to start recognizing that the work of being a consultant broker isn’t done in the 60 days pre of the renewal by then the work has already happened, at least it should have.

You’d be getting in there understanding data, making recommendations, identifying low-cost high-quality facilities, by the way, in healthcare, it’s the one area of our economic sector where cost does not equate to quality. Typically the lowest cost are the best. So go find the lowest cost you’re gonna get the best service most of the time. Most everyone is pooled so recognize that who’s in your pool so whether you look at captives where you look at pooling arrangements whatever that is you need to start recognizing and it’s not just your performance that ultimately will impact you it’s the other people around you. You need to get engaged with your insurance company whether you’re fully insured or self-funded of understanding the pool structure ask questions get them answered you don’t like the answers go find somebody else. That’s the American Way! Start being a consumer and acting like it. That’s the only thing that’s gonna start solving this problem don’t be subservient to the industry. Take control of it. Costs does not equate to quality. We said that, right? So again start recognizing the healthcare components in and around you and what their costs are there’s multiple resources that are out there via the internet, by organizations like what you guys are doing through the FMMA.

Utilize those resources. Make sure your employees are utilizing their resources. Incentivize them to do that. Recognize that loyalty is a non-starter and that again, that doctor is ultimately the sales force. Do you want them working for you or do you want them working for the other guy? Again, as we think about the overall process, we must start to think about it differently. In the end , we are the only ones that can ultimately cure healthcare in the United States. I like the saying and I actually wrote it in my book, there’s two types of things and I appreciated the ‘The Lorax.’ I was actually called that by a news reporter who after telling them our message they said, “You’re kind of like the Lorax of the healthcare industry,” and the Lorax, there’s a little statement a matter of fact, if you have my book you will see it at the very beginning, it says this, “Unless someone like you cares a whole awful lot, things aren’t going to get better. They just aren’t.” So thanks for caring thanks for spending some time with us this evening. I hope it was valuable to you hopefully it was as entertaining as it could be and shockingly, the Sun never set behind me here in downtown Dallas. Good to be with you. Thanks.

Q&A Session | Question by Dr. Arti Thangudu

Shankar Poncelet: Well, thank you, so much Seth. I know that you agreed to answer a few questions from our audience. Robert Lehrer had a question that was posted in the chat. His question was, “Seth. Let’s say that your hope that insurance companies are replaced comes true, what would small businesses replace them with if they can’t fully self insure their employees?”

Seth Denson: Yes, so let me clarify something I said. I didn’t say health insurance companies need to be replaced. I think there’s always going to be a fit for the health insurance industry. What I said was that I was replaced. The consultant was the person that needed to help navigate the healthcare space. The healthcare space should operate like an Amazon shop. Like a trip to the mall. It should be very clear and present what prices are. The American consumer doesn’t need me if they were actually a consumer they’re just not when it comes to healthcare. But the insurance company will always play a role in and in the same way that our mortgage company plays a role or the company that we financed our car with. Here’s the reality though. Sadly, in the healthcare space, we finance everything but we don’t finance milk, eggs, and fabric softener. But why do we finance flu shots, Lipitor and the x-ray? We shouldn’t. The insurance company needs to play a role to help us finance those things that maybe we can’t pay for today but that’s a role that they need to play not necessarily building networks or owning PBMs and so on and so forth and if we would restructure how the health insurance industry works then we certainly would get to a place where small employers or large employers it wouldn’t matter you’re going to have access to resources.

Shankar Poncelet: Thank you. The next question is going to be asked by Dr. Arti Thangudu. Arti, I’m going to ask you to unmute yourself.

Dr. Arti Thangudu: I’m unmuted.

Shankar Poncelet: Perfect! Go ahead.

Dr. Arti Thangudu: Thanks, Shankar. Thanks so much for your talk I’m an endocrinologist in San Antonio and I have a lifestyle-focused practice that focuses on improving health outcomes in diabetes by optimizing lifestyle so reducing need for prescription medications and my question for you is one, it’s twofold. One, how do you engage employers, because we all in DPC know that we’re were cost savings? I definitely know that in the way of diabetes. Diabetes is one of the most expensive diseases that we’re dealing with right now and if we can get patients healthier and reduce their need for medication we’re providing a huge cost saving. So one, how do we engage employers to understand that amount of cost savings? Two, I know there was a Rand study a few years ago that showed that diseased focus wellness programs are the part of wellness programs that is cost savings whereas the general wellness programs aren’t and I just was wondering if you could speak on that a little bit and if that’s a known thing amongst employers.

Seth Denson: Yeah, so let’s take the first part of the question, and first of all, thank you for your work. I think it is a critical component. Again, I said it now three times, we know where the costs are if we would focus on those costs and work to solve them. The system would be in a better place and health care impact would be positive so how do we get employers to the plate. Well, we have to stop talking to them about insurance that’s the first thing we got to stop doing. Sadly, they’ve been trained to think that so here’s a simple way that we talk about it a lot employers have high and large lists that are successful of learning how to think long term right. So if I go to it to the CEO of a company or a CFO typically I’m going if I ask them about the top five things on their P&L they’re going to give me long term responses as to how they’re handling those right? So most companies don’t sign one-year leases on buildings. They sign multi-year leases where when they build a building they don’t go “well this is gonna be a great building for me for the next year, and then I’m going to have to solve it all over again,” right? When they go hire employees they typically go, “Boy this is gonna be a really great employee for the next 12 months, and then I’m gonna have to hire them and start all over.” Right?

Now we’ve all had those employees sadly, but that doesn’t mean that’s the way we approach it, no, we think long-term was the long-term impact of this sadly when it comes to health care it’s all short-term. We train them to think in 12-month cycles but here’s a newsflash: If you’re an employer you’re going to provide health care much longer than 12 months. Remember Bernie’s not going to be President. Medicare-for-all is not coming. Okay, so you’re going to be providing health care for a very long time why in the world are we only thinking about it in 12 months cycles you want to start reducing the cost you have to start thinking about cost. What else did I say, I said that the only way to reduce cost is to reduce the number of claims that are consumed or the price in which they are consumed 90% of those costs are generated by 6% of your population so why not start focusing heavily on that 6% and get them engaged with someone like yourself. They want to see costs go down that’s how they do it here’s the other flip side of that, that’s the benefit it’s a better experience for the employee so this is what we used to refer to as the unicorn, “You mean, I can actually improve the value of benefits while simultaneously reducing my cost?” yeah you sure can but you have to think about it differently this whole idea of, “Oh well we want people to go wherever they want, whenever they want to go,” there that’s hogwash. It’s garbage. Let them go there they’re free, it’s a free market. They spend their money but if they’re spending your money give them the best and tell them to go there and if they do you’ll pay for it and you’ll end up paying less for it.

By the way, if your employees think it’s free they’re going to go there and they’re going to thank you for it along the way and their care is going to get better. We have to get blunt with how we talk to employers and recognize that not all of them are going to buy in and that’s part of it so we move on because there’s plenty that are out there searching for this. They’re so thirsty they’ll drink sand in lieu of water they want it so bad but they need to hear a different message so thank you for that. Now the second part of the question was wellness-based plans that are specific to chronic conditions. I said earlier I’m not a big fan of wellness plans unless now the unless part is if you have data specific wellness plans that you’re trying to put in I’m not trying to go get Johnny gym-goer to go to the gym and incentivize him to do it why he’s already doing it. I don’t need to do anything there. What I’m trying to do is go get Susie on insulin sitting on her chair because she doesn’t know what else to do a higher-level engagement with a doctor that wants to guide her and give her the care the vast majority of people want to do what they should do they just don’t know how and when they do finally seek out a doctor. They’re too intimidated to ask the questions they need to ask for fear and there is a self-esteem issue, there’s intimidation, there’s all of that.

People like yourself break those walls down we need to engage people more with people like yourself to get those people better. They’ll be benefiting, in the end, the employer will – and if a wellness program that creates an incentive structure data-based wellness is the only way to do wellness. If you don’t have data-supported wellness programs you’re throwing money away but data-based chronic wellness programs they’re a very good thing. Thank you so much that was very helpful. By the way, I have a 10,000 word a day minimum and I think that you guys have helped me hit it here today so thank you.

Shankar Poncelet: Thank you so much for that question Arti and thank you Seth for a great answer. I am going to allow a few more people to ask a question. Let’s see if we can have a conversation here and if not we will move on to some final remarks.

Seth Denson: So there’s questions I think that just came across it looks like Andrew can you read it out loud for me. Great so it’s specific to Direct Primary Care what size employers, how often do people use it. I will tell you the people don’t nearly use it as often as they should if I had if I had my way every company would have direct primary care that I represent I think that is the low-hanging fruit that is the ability of taking the milk in the grocery store and bringing it to the front of the grocery store and likely Dr. Roger could comment on this as well but I will tell you that there is no employer too big or too small that can implement direct primary care and there are programs out there available to you a direct primary care is a contract directly with whichever primary care group or doctor you want to engage with. Dr. Roger does a great job as a just kind of a plug for him I think that their organization does phenomenal work in that space you want direct primary care doctors that are going to engage with your employees that’s the key right in and certainly they’re going to help guide you through acute care challenges but chronic care challenges as well that is the critical component here and so there’s no company too small prices will be based on your employee account but at the end of the day you’re paying for it I’m telling you you’re paying for it you’ve got to start rethinking where your money’s going and maybe even Dr. Roger if you had a thought on that you can unmute yourself and address that too.

Dr. Roger Moczygemba: Thank you. I’m really passionate about Direct Primary Care. It’s been absolutely refreshing and wonderful to see the position that I’m in to interact with my patients and my employer clients during the COVID pandemic and it’s become even clearer to me that unfortunately individuals and employers who are paying their insurance premiums are not getting what they think they’re paying for. They think that by having insurance it’s access to a doctor you know but it’s not the same thing. My point is during our pandemic our patients and our employer clients had access to me and the clinicians in my clinic just like without a hitch at all I mean we didn’t shut down like some of my colleagues their offices were shut down because they were built on that model of having people come in so the doctor could submit a claim for reimbursement to the insurance company. Well we didn’t have that and so we already had the technology tools in place where had the relationships in place with our patients with our employer clients and it was a beautiful thing we did not suffer as a DPC clinic, our patients didn’t suffer access, they had lots of questions they had fears and because of our direct relationship we could answer their questions, answer their fears, and concerns and it was a beautiful thing it was like you know sometimes we talk about what we do is restore the old doctor-patient relationship. It was just a beautiful thing. We’re just in a great place and I hope that not only has the COVID crisis shined a big light on telemedicine but I hope that it will also shine a big light on helping on direct primary care and helping people like you’ve been talking about rethink or take apart of the system and put it back together in a way that works for them.

Shankar Poncelet: Right, thank you Dr. Roger Moczygemba for these comments. I did want to point out a link that we were very glad to have field representatives of Congressman Chip Roy here. Jacqueline Hall was amongst the audience and during this conversation about our dependence on Chinese drugs she pointed out an act that the congressman was working on and I’m just going to post a link to that here in the general chat if you guys want to read that seems very interesting. Furthermore, I cannot thank Seth Denson enough that he took the time to do this presentation here tonight if people want to work with you and find out more about you I know you have the website sethdenson.com where people can reach out. Finally, I think it’s always important to get feedback on how well we did providing this webinar to you so I’m going to post another link here in the general chat that is a very short survey for you guys to thank you so much for helping us out with that. I see there we go now it is in the general chat and last but not least we want to make sure that we stay connected with each other all of you who have attended this webinar are part of the mailing list that ever made send out. I will also ask you to join us as a member it is free to be a local chapter member I’m going to post a link again to a website where you will find the membership application form thank you all so much for having attended this webinar. I wish you a very very good evening and hope you stay safe. Goodbye, everyone.

Recent Comments